The crypto derivatives market is facing a major test today as over $6 billion in Bitcoin (BTC) and Ethereum (ETH) options expire.

Today’s expiring options sets the stage for strategic repositioning among traders and potential heightened volatility into the weekend.

Bitcoin, Ethereum Options Expiry Looms with Over $6 Billion at Stake

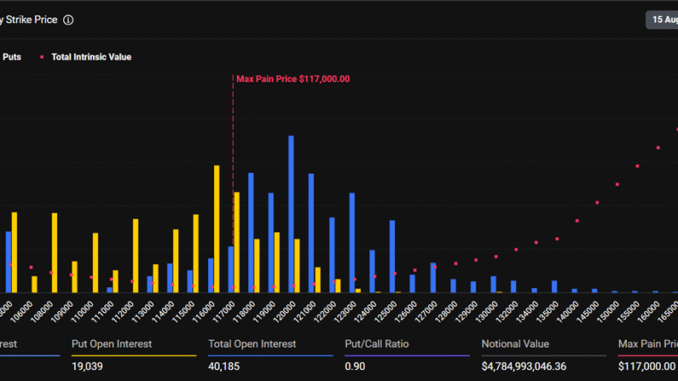

Data on Deribit shows Bitcoin’s max pain level, the strike price at which the most options lose value, is at $117,000. As of this writing, BTC was trading for $118,995, slightly higher than its strike price.

The put-call ratio (PCR) for today’s expiring Bitcoin options is 0.90. This suggests slightly more calls (Purchase orders) than puts (Sale orders), which signifies bullish positioning despite price trading above its max pain level.

Meanwhile, the notional value is $4.78 billion, and open interest (OI) is at 40,185 contracts.

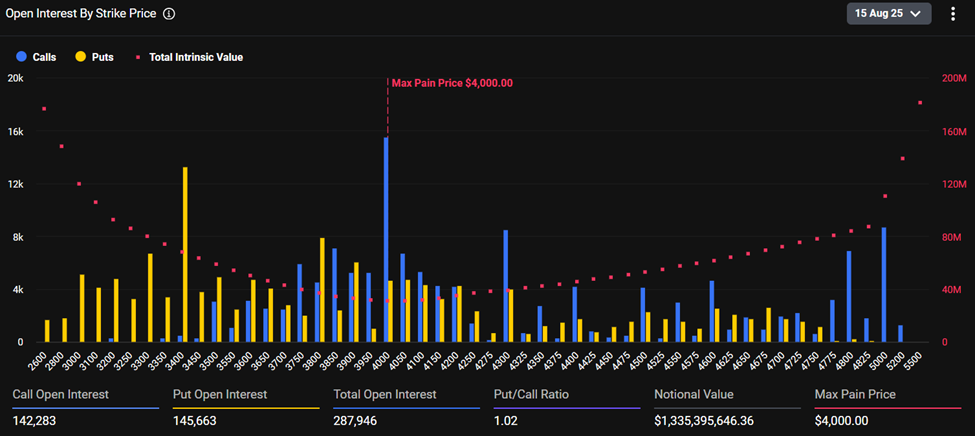

Meanwhile, Ethereum’s maximum pain is $4,000, significantly lower than its price, which is $4,629 as of this writing.

The PCR for today’s expiring Ethereum options is at 1.02. It indicates a balanced market with a slight tilt toward puts (Sale options).

This PCR, relative to the current ETH price, suggests investors may be anticipating a correction.

Data on Deribit shows that today’s expiring ETH options have a notional value of $1.33 billion. Meanwhile, the open interest is 287,946 contracts.

Today’s expiring options are slightly higher than last week’s, where nearly $5 billion worth of contracts went bust.

Meanwhile, according to Greeks.live, this Friday’s expiring options come amid a market still digesting an unexpected correction triggered by macro data, even as sentiment remains tilted toward a sustained bull market.

More closely, Greeks.live analysts note that as Bitcoin price hit a new all-time high and ETH neared its ATH, the market experienced an unexpected correction. An unexpectedly strong PPI (Producer Price Index) reading primarily triggered this.

As it happened, Core CPI inflation is back above +3% and PPI inflation is at its hottest since March 2022. Specifically, PPI inflation peaked at 3.7% versus 2.9% expected and 2.6% previous month.

Despite this, analysts at Greek.live reported no major changes in the options market. There were no significant changes in the main term IV (implied volatility) and relatively small fluctuations in skew.

Record-Breaking Options Volume Meets Infinite Bid

Importantly, Deribit options exchange saw $10.9 billion in trading volume. It broke the $10 billion mark for the first time in a single day.

“The high trading enthusiasm shows that the market is not worried about the follow-up market, and the bull market is likely to continue,” Greeks.live said.

Notwithstanding, market sentiment remains split. Some traders point to infinite bid conditions and unstoppable upside momentum.

Meanwhile, others warn of a potential local top near the $122,000 for Bitcoin and $4,700 for ETH levels. Peak open interest, coinciding with all-time-high spot prices, creates an unusual market structure.

“…market makers [are] pulling asks due to overwhelming bid strength, with massive 10m volume candles indicating institutional accumulation,” Greeks. live noted.

Reportedly, one trader sold 115,000 BTC puts for next week at the top, demonstrating tactical put selling into strength.

With such concentrated open interest and record-breaking volumes, today’s expiring options could be a magnet for prices toward max pain levels, at least in the short term.

Markets tend to return to normalcy after options expire at 8:00 UTC on Deribit, as traders adjust to new trading environments.

Nevertheless, traders should monitor for post-expiry price action to see whether the infinite bid momentum persists or profit-taking triggers a deeper pullback.

Record demand, institutional participation, and macro-driven uncertainty set the stage for a high-stakes weekend in crypto markets.

The post Over $6 Billion Bitcoin and Ethereum Options Expire Today: What Trades Should Expect appeared first on BeInCrypto.

Be the first to comment